However, if you have a long-term perspective, it's easy to make the case that AMD is being significantly undervalued at a price-to-earnings (P/E) ratio of 14.6. Investors might want to wait for the dust to settle before rushing to buy any of these beaten-down growth stocks. Nvidia's data center revenue growth decelerated from 83% in Q1 to 61% in Q2, which is not the trend investors want to see. Some analysts fear that the accelerating decline in PC shipments will eventually spill over to the enterprise market. Intel's capital expenditures were up 56% in the first half of the year, which is pressuring profitability just as PC shipments are starting to plunge.īoth AMD and Nvidia have reported strong growth in their respective data center segments this year, but investors are starting to get nervous. The company is spending billions of dollars to speed up innovation and expand domestic manufacturing capacity to regain control of the supply chain and market leadership.

But execution issues appear to be Chipzilla's biggest problem. Intel saw revenue fall 22% year over year in the last quarter, citing the weakening demand in the PC market and economy overall. Even with the revised figure for the upcoming earnings report, AMD's revenue will still be up 29% year over year, which is much better than Intel. This means AMD is still running circles around Intel in the consumer and enterprise central processing unit (CPU) market. On a positive note, AMD said that revenue across data center, gaming, and embedded segments each grew "significantly year over year," consistent with expectations. AMD's revenue increased by at least 70% year over year in the first two quarters of the year, but that momentum is apparently over for now. Nvidia had started to see its gaming segment decelerate as early as Q1 of this year.

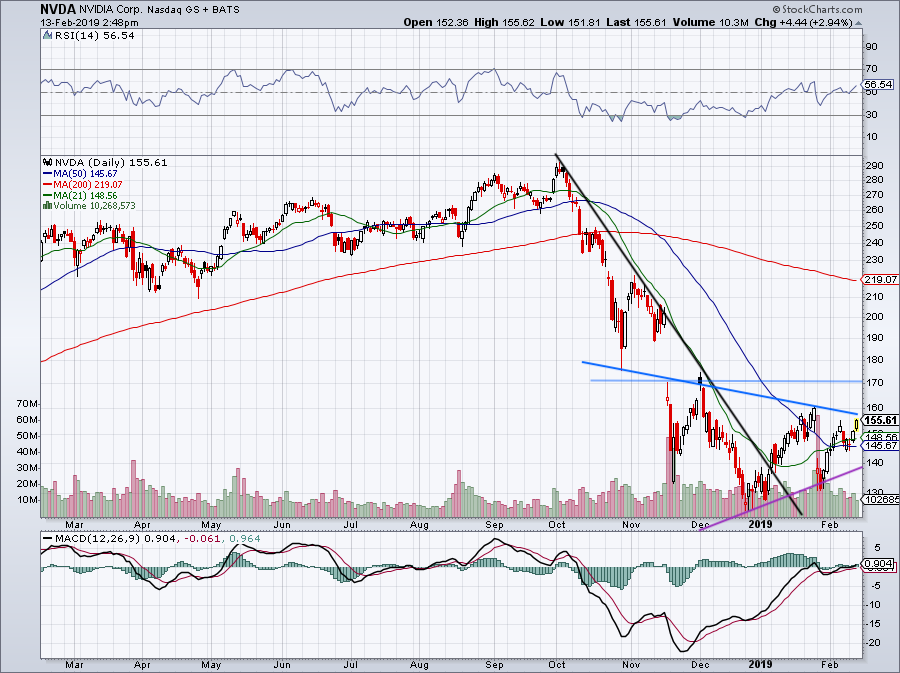

Intel and Nvidia had already reported weakening revenue growth in the last quarter - a sign of how bad things are getting across the semiconductor industry. This caps off a rough year for AMD, with its stock price already lower by 50% year to date, despite still being on pace to report strong full-year revenue growth. AMD won't release fiscal third-quarter results until November, but it announced preliminary revenue of approximately $5.6 billion for the quarter, missing management's forecast for $6.7 billion.Īs a result, investors hit the sell button on chip stocks, sending shares of Advanced Micro Devices down by 10.9%, Nvidia (NASDAQ: NVDA) by 6.8%, and Intel (NASDAQ: INTC) by 4% as of 12:40 p.m. Shares of leading chip stocks were tumbling today after Advanced Micro Devices (NASDAQ: AMD) confirmed what investors had been fearing: a severe downturn in PC demand.

0 kommentar(er)

0 kommentar(er)